|

Fintech Hub LT welcomes new Management Board

During Fintech Hub LT General Assembly held on 22 February, we welcomed a fresh wave of leadership as the new board was elected to steer us towards greater heights! Introducing the new board members: 🔹 Asta Grigaityte, General Manager at FinXP 🔹 Daumantas Dvilinskas, CEO & Co-Founder of TransferGo 🔹 Marius Galdikas, CEO at ConnectPay 🔹 Vaiva Amulė, Lecturer at VGTU 🔹 Juozas Kaminskas, VP Banking & Issuing at Nuvei 🔹 Virgilijus Mirkes, General Manager at Airwallex 🔹 Mindaugas Petrauskas, Head of Financial Crime Prevention at AMLYZE 🔹 Saulius Racevicius, Founder & Director of Fronteria Financial Advisory Services Exciting times ahead as we embark on this journey together with such a diverse and accomplished team! |

Greta Ranonytė appointed Head of Fintech Hub LTFrom October 2, 2023, Greta Ranonytė has been appointed as Head of Association Fintech HUB LT.

For the last 5 years Greta Ranonytė worked at the Ministry of Finance of the Republic of Lithuania, where, amont other projects she has been a driving force in preparing the Lithuanian Fintech Guidelines for 2023-2028. |

How Lithuania Could Become Europe’s Next Fintech HubLithuania has been rapidly emerging as a hub for fintech companies in Europe over the last few years. The country has seen a surge in the number of fintech startups, with several established companies relocating their operations to Lithuania due to the country's favorable regulatory environment and its highly skilled workforce in the technology and financial services sectors.

Yet in a quickly changing market, can it keep up with other contenders across Europe to establish itself as a leading fintech hub in Europe? Read on to find out why it might well be able to. |

The US Internal Revenue Service includes Lithuania in approved KYC country list

Lithuania joins the US IRS list of KYC-approved jurisdictions, allowing its fintechs to register as QIs, saving time and effort. The move also boosts the country's fintech sector.

The US Internal Revenue Service (IRS) has a list of jurisdictions with approved know your customer (KYC) rules. This list is essential for financial institutions to identify countries that have adequate anti-money laundering and counter-terrorist financing frameworks. The IRS regularly updates the list of countries that comply with KYC rules. Financial institutions, including banks and other financial intermediaries, use the list to determine if a country's KYC framework is robust enough to warrant further engagement. The list includes countries that have demonstrated a commitment to fighting money laundering, terrorism financing, and other financial crimes. Read on.

The US Internal Revenue Service (IRS) has a list of jurisdictions with approved know your customer (KYC) rules. This list is essential for financial institutions to identify countries that have adequate anti-money laundering and counter-terrorist financing frameworks. The IRS regularly updates the list of countries that comply with KYC rules. Financial institutions, including banks and other financial intermediaries, use the list to determine if a country's KYC framework is robust enough to warrant further engagement. The list includes countries that have demonstrated a commitment to fighting money laundering, terrorism financing, and other financial crimes. Read on.

Vaiva Amulė, Head of Fintech Hub LT awarded as Fintech Leader of the YearVaiva Amulė, Head of Fintech Hub LT, was recognised as Fintech Leader of the Year. According to her, the objectives of the association are to create and develop a dialogue between the fintech community and the regulator and government institutions, to create a unified direction in the sector, and to seek leadership in the export of fintech services to Europe.

“The recognition of Lithuania as a fintech country in the international sphere shows that we are headed in the right direction. This is why I dedicate this award to the fintech community because it is an appreciation of all our hard work. This award is a great incentive for fintech companies to continue to grow successfully, provide innovative services, and develop new products and partnerships, which will benefit not only people in Lithuania, but also throughout the European Union,” says Ms Amulė. Full article can be found here . |

Fintech Day 2023: Nordic and Baltic countries could dictate global financial trends

|

The conference was organised by the Financial technology and sustainable innovation centre Rockit and Fintech Hub LT. Institutional and business representatives from the Ministry of Finance of the Republic of Lithuania, the Bank of Lithuania, the UK Embassy, Invest Lithuania, leading fintech companies and start-ups, finance and legal advisors and venture capital funds participated in the discussions on the ecosystem’s challenges and perspectives. The participants of the conference will be welcomed by Gintarė Skaistė, the Minister of Finance. Read more.

|

At Money 20/20 Conference – Never Before Seen Gathering of Lithuania’s Fintech CommunityEurope’s largest Fintech conference will bring together the world’s most successful Fintech representatives and investors. This time they will be joined by a large team from Lithuania. For the first time, “Money 20/20” will mobilise and co-present our country’s Fintech community − start-ups, associations, and institutions.

At the event and expo in Amsterdam, under the name “LITHUANIA” will be presented Invest Lithuania, ROCKIT, Go Vilnius, Fintech Hub LT, EMBank, Fininbox, Ondato and Velmie. Also, more than 100 representatives from 25 Lithuanian Fintech companies will also travel to attend the conference. Full article can be found here. |

Asta Grigaitytė appointed the Chairwoman of the Board of the Fintech HUB LTAsta Grigaitytė joins the group from the Bank of Lithuania where she worked on CENTROlink, a payment system developed and operated by the central bank which allows customers of financial institutions to execute euro payments across the Single Euro Payments Area (SEPA).

“In recent years, the Electronic Money Institutions (EMI) and Payment Institutions (PI) sector has grown rapidly in Lithuania,” Grigaitytė says. Read more. |

Fintech Hub LT has elected a new Board

|

Fintech HUB LT, an association of licensed Fintech companies in Lithuania, has elected a new board. It consists of 8 persons, who will soon elect a board chairperson.

The new board of Fintech HUB LT includes a member of the board of Seven Seas Finance Titas Budrys, fintech expert Asta Grigaitytė, ECOVIS ProventusLaw partner and lawyer Inga Karulaitytė-Kvainauskienė, Nikulipe Chief Commercial Officer Erika Maslauskaitė, Fin-Ally! Founder and CEO Alexandre Pinot, Founder and CEO of Fronteria Financial Advisory Services Saulius Racevičius, and CEO of NEO Finance Paulius Tarbūnas are joining the new Fintech HUB LT managing board. The eighth and final member of the board will be elected by a separate ballot, as two candidates received the same number of votes in the election. Fintech HUB LT currently brings together 60 Fintech sector players in Lithuania, including companies such as Vinted, Paysera, and ConnectPay. Since the beginning of 2021, the association has added almost 20 new members. Last year, over 10 sponsors joined the Association. |

“I am very glad that our association is growing rapidly every year and bringing more and more fintech experts together in one community. Only by being together, sharing our good experience and ideas, we can significantly contribute to the development of the Lithuanian fintech sector, to making it known in the world and to attracting new investments,” says Vaiva Amulė, Head of Fintech Hub LT.

The association is in regular contact with regulators such as the Bank of Lithuania representatives and the Government of Lithuania, and other responsible institutions. The aim is to help create favourable conditions for fintech companies to operate and contribute to making Lithuania a centre of gravity for fintech companies in the Baltic region and across the European Union.

Fintech Hub LT was recognised as the most progressive fintech association in the Baltic States in the 2021 Fintech Awards, published by the UK’s Wealth & Finance magazine.

In 2021, the revenues of Fintech HUB LT’s members more than doubled compared to 2020, reaching over EUR 167 million. The sum of payment transactions also doubled to EUR 46 billion. According to the Bank of Lithuania, the total amount of payment transactions carried out by Fintech companies in the first half of last year amounted to EUR 121,8 billion – 5,7 times more than in the same period last year. In addition, companies received revenues of EUR 208,2 million from licensing activities, 5,1 times more than in January-June 2020, 94% of which were generated by e-money and 6% by payment institutions.

The association is in regular contact with regulators such as the Bank of Lithuania representatives and the Government of Lithuania, and other responsible institutions. The aim is to help create favourable conditions for fintech companies to operate and contribute to making Lithuania a centre of gravity for fintech companies in the Baltic region and across the European Union.

Fintech Hub LT was recognised as the most progressive fintech association in the Baltic States in the 2021 Fintech Awards, published by the UK’s Wealth & Finance magazine.

In 2021, the revenues of Fintech HUB LT’s members more than doubled compared to 2020, reaching over EUR 167 million. The sum of payment transactions also doubled to EUR 46 billion. According to the Bank of Lithuania, the total amount of payment transactions carried out by Fintech companies in the first half of last year amounted to EUR 121,8 billion – 5,7 times more than in the same period last year. In addition, companies received revenues of EUR 208,2 million from licensing activities, 5,1 times more than in January-June 2020, 94% of which were generated by e-money and 6% by payment institutions.

Fintech Hub LT initiates a platform for exchanging information about suspicious clients and transactions

|

The Fintech Hub LT Association seeks to create a special IT platform that would allow financial institutions operating in Lithuania to securely exchange information about clients engaged in potentially suspicious or illegal activities and other information directly related to criminal activities. The platform's information will also be available to financial sector supervisors and law enforcement authorities. With this type of enriched AML data, the members and other financial institutions can strengthen their AML defenses.

The Fintech Hub LT Association discussed the information exchange model with the representatives of the Ministry of Finance, the Bank of Lithuania, FNTT, and the Money Laundering Prevention Competence Center. Read more: here |

Fintech Hub LT starts new self-regulation initiativeFintech Hub LT is happy to share more information on its existing and upcoming self-regulation initiatives, which includes Code of Ethics, Self-check questionnaires, cooperation with the Bank of Lithuania, FIU (FNTT), State Tax Inspectorate and other government agencies.

|

Fintech HUB LT shares views on Lithuanian Fintech sector success factors at Mastercard Lighthouse 2020

|

In the pandemic-burdened world, Lithuanian Fintechs show amazing results, as companies across the fintech sector offer answers to those wrestling with today’s new set of problems. FIntech Hub LT chairman Titas Budrys and member Liudas Kanapienis (Ondato) shined and shared their views on the success factors at Mastercard Lighthouse day 2020 Grand Finale by Slush powered by ROCKIT Vilnius.

|

Fintech Hub LT has a new Head for the Association!Fintech Hub LT has the new Head for our Association. Please warmly welcome Vaiva Amulė!

She has been working with Fintech Ecosystem in Lithuania for a while now, and we are confident that she will push the association to a next level. Vaiva will be working closely with the Members and Board of Fintech Hub LT, but feel she contact her directly if you have any questions about us or Fintech sector in Lithuania. |

FINTECH HUB LT invites Lithuanian Fintechs to participate in Singapore Fintech Festival 2019The world’s largest FinTech festival 2019 edition is back in Singapore on 11-15 Nov! Attended by 45,000 participants from 130 countries in 2018, the event brings together key executives and decision makers from global financial institutions and corporates, start-ups and unicorns. This year, the festival features FinTech Conference & Exhibition, FinTech Awards, Global FinTech Hackcelerator Demo Day, Global Investor Summit and Innovation Lab Crawl. Get plugged into this leading platform where you can accelerate dialogues within the FinTech community, explore opportunities and gain access to the latest innovations and developments in the market. Register now

Date: November 11-15, 2019 Place: Singapore Participants: close to 45 000 participants from almost 130 countries More info: www.fintechfestival.sg |

Fintech HUB LT participates in the consultation by the Bank of Lithuania on increasing the protection of customer fundsFINTECH HUB LT and its members welcomed the timing and contents of the public consultation by the Bank of Lithuania, seeking the opinion from Payment Service Providers (PSPs), users, market experts and public sector representatives on safeguarding customer funds held by Electronic Money and Payment Institutions (EMIs/PIs), i.e. what measures would help to increase the protection of such funds and strengthen the confidence of the market and public in these institutions. The consultation and its text could be found here.

The association strongly agreed with the mentioned potential risks arising from the lack of the protection of funds received from customers of EMIs/PIs in Lithuania, as well as the protection of EMIs/PIs themselves in case of insolvency of the credit institution (i.e. commercial banks) where customer funds are kept. Besides discussing the reasons that lead to increased risks related to safeguarding EMIs/PIs customer funds and providing answers to the questions from the Bank of Lithuania, Fintech Hub LT proposed 5 additional measures that could strengthen the protection of EMIs/PIs own and their clients' funds on the national legal and infrastructure levels. You can find the full text below.

| |||

Fintech HUB LT and ECOVIS offer double internship opportunity - Summer, 2019

|

Fintech HUB LT and law firm Ecovis Proventus Law are currently looking for Interns for the Summer of 2019.

WE OFFER an interesting opportunity to work within a group of 26 FinTech companies in Lithuania, learn about different business models and gain valuable expierence. WE EXPECT interns to help us with organizing the work of the Association, work closely with our members, partners and other association, spreading the news about us, organizing our events, participating in other events and conferences on behalf of the Association. WE ARE OPEN to different internship terms and agreements including 3 party internship agreements with universities, full-time and part-time internships, etc. GET IN TOUCH with us now via [email protected] |

Fintech HUB LT partners with Rise VilniusRISE VILNIUS, backed by Barclays Bank, provides a physical site open for innovative FinTech companies & startups, offering a co-working space, trendy auditorium for events and meeting rooms. It has become the home for worldclass mentorship, hackathons and various events in Vilnius.

The association Fintech Hub LT has signed an agreement and plans to hold monthly FinTech related events for its members and outside guests at Rise Vilnius. The first 2 events will involve the experts from the Ministry of Finance of the Republic of Lithuania and the Bank of Lithuania. More information about Rise Vilnius: www.facebook.com/pg/ThinkRiseVLN |

Fintech HUB LT invites Fintechs to participate in Fintech Smart Village hosted by Forum Banca in Milan, ItalyAs the only event in Italy, Fintech Smart Village has established itself as the Business Ecosystem for the Fintech world in which Banks, FinTech and VC/Accelerators present, discuss and share new innovation strategies.

Date: October 1, 2019 Place: Milano Congress Centre, Italy Price: Special deals are available More info: https://www.forumbanca.com/fintech-smart-village |

Fintech HUB LT conducted Cost-Benefit Analysis of growing Fintech sector in LithuaniaONE OF FINTECH HUB LT Board Members, Titas Budrys, has conducted Cost-Benefit Analysis of the Fintech sector in Lithuania. The recent success by the country has been met with the growing public concern that such a rapid increase in financial companies, many coming from abroad, may pose numerous related risks.

Using members of the association as an example for analysis, it was estimated that the total net benefits to Lithuania brought by the growing Fintech sector could reach ~50 million EUR per year. Moreover, the total net benefits of a long-term Fintech strategy for Lithuania could bring up to 660 million EUR in 10 years if the growth continues and related risks are well managed. You can find full analysis here or download it on the right. |

| ||

|

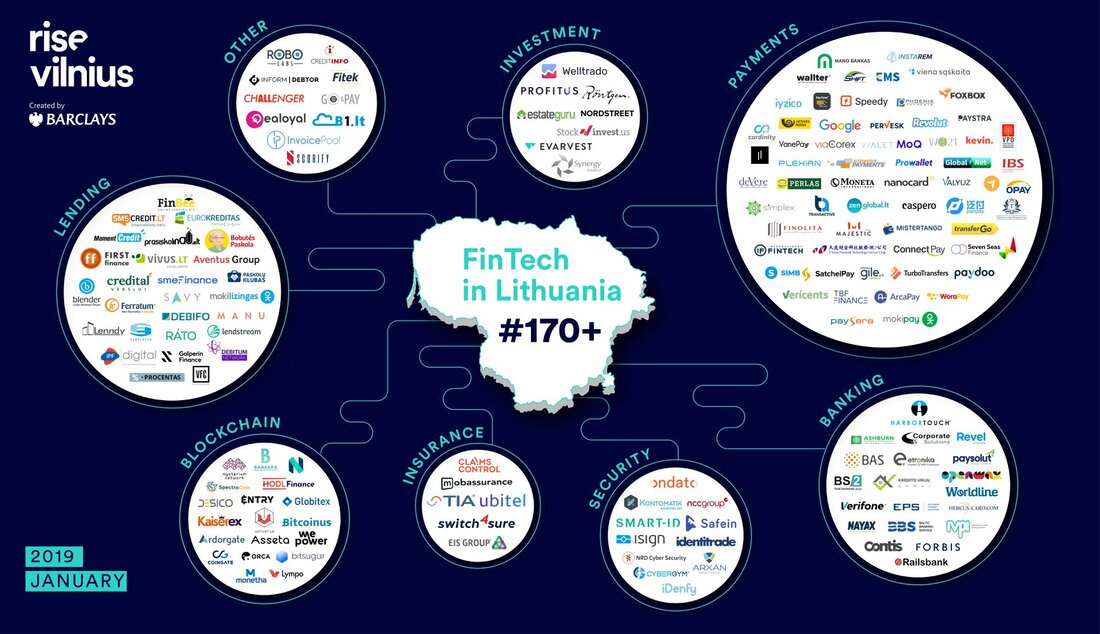

Invest Lithuania publishes the Fintech Landscape in Lithuania Report 2018ACCORDING TO THE REPORT, Fintech sector in Lithuania is experiencing a dramatic growth, which lead to sector doubling in size over the last two years. In 2018, the number of Fintechs in the country’s close-knit Fintech ecosystem grew by 45% to the total of 170 companies with more than 2,600 specialists employed in the country. In addition, Lithuania became a strong leader in the continental Europe by a number of licensed electronic money institutions there and 2nd in the EU after the UK.

You can find full report here and the summary by the representatives of the Bank of Lithuania, the Ministry of Finance, Invest Lithuania and Rise Vilnius here. | ||

Fintech HUB LT members agree on and sign the Code of EthicsALL MEMBERS OF THE FINTECH HUB LT have agreed on and signed the Code of Ethics - a document setting ethical standards for all the members of Association and their employees.

The Code of Ethics of the Association Fintech Hub LT specified the relationships between the Association and its members, between the members among each other, as well as between the members and all other stakeholders - customers, partners and regulators. Furthermore, it shall act as a way for all the stakeholders of the Association to get a clear understanding of what they can expect from the Association and its members. All the members agreed that they will ensure by appropriate means that they themselves and their employees read and follow the Code of Ethics.

| |||

Finetch HUB LT participated in the FinTech INN conference in Vilnius, Lithuania, attended by 1500 peopleTHE LARGEST FINTECH CONFERENCE in the Baltic countries took place in Vilnius, Lithuania on November 8, organized by Ministry of Finance of the Republic of Lithuania, Bank of Lithuania, Invest Lithuania and Agency for Science, Innovation and Technology. More than 1500 international and Lithuanian experts, business representatives, and others interested in the development of the FinTech sector in attendance, the event focused on the latest trends, challenges and opportunities in the financial technologies.

Sigute Kunceviciute, Chair of the Board of Fintech Hub LT participated in a panel discussion "Connecting the Unconnected / Corresponding Banking Challenges". Fintech Hub LT not only helped with the organisation of this conference contributing with its resources, speakers and panelists, as well as had a stand and presented the association and its activities to the conference participants. More relevant information about the conference could be found here: http://fintechinn.lt |

Ondato, a member of Fintech HUB LT, becomes finalist of MasterCard Lighthouse Development ProgramLIGHTHOUSE DEVELOPMENT PROGRAM was established as a joint effort between MasterCard and NFT Ventures. The program is dedicated for promoting start-ups working with solutions for financial markets.

|

Fintech HUB LT was invited to join the discussion with the International Monetary Fund (IMF)Fintech HUB LT was invited to join the discussion with the International Monetary Fund (IMF) mission to Lithuania. An IMF mission visisited Vilnius during October 23-29, 2018, to discuss recent economic developments and policy priorities with the Lithuanian authorities and local businesses. The Association's members presented its views regarding policies and regulatory environment related to FinTechs in Lithuania.

|

The Bank of Lithuania has initiated discussion between Fintech companies and Commercial BanksFINTECH HUB LT was invited to join the discussion organised by the Bank of Lithuania regarding challenges faced while opening accounts at commercial banks. The Association presented its views regarding measures that should help to increase cooperation between different players in financial market. |

Fintech HUB LT member meeting newsDURING FINTECH HUB LT members meeting, Association members were introduced to a new exclusive project composed by the Association's intern. An extensive list of laws, both in Lithuanian and English and applicable both to Electonic Money Institutions and Payment Institutions, has been composed and presented. This product will provide members with a more convenient way to seek legal advice.

|

PAYMENT SERVICE DIRECTIVE 2 (PSD2) bringing changes to FinTech sectorTHE EUROPEAN UNION'S objective of unifying the European financial service market has come one step closer to realization with the newly implemented Payment Services Directive (PSD2) 2. In essence, this initiative allows third-party financial service providers to offer account information and payment initiation services through API's (Application Programme Interface) without having to rely on a bank as a mediator. Banks across the EU are obliged to issue access to customers' accounts and open up the interface until 14 September 2019. In Lithuania, the country's regulator - the Bank of Lithuania - has made its priority until 2020 to encourage the development of instant payments, therefore putting special measures in place to ease the legislation process for FinTech companies.

|

Fintech HUB LT will participate in the FinTech INN conference which will take place on November 8th, 2018FINTECH HUB LT has been invited to participate in the Financial Technologies Conference, organised by the Ministry of Finance of the Republic of Lithuania and the Bank of Lithuania in cooperation with Invest Lithuania and Agency for Science, Innovation and Technology. This year’s event will be dedicated to discuss about challenges for FinTech industry and its benefits for the society.

More relevant information about speakers, organizers, agenda and etc. could be found here: http://fintechinn.lt |

Fintech HUB LT participated in the conference for 150 Honorary Consuls to LithuaniaFINTECH HUB LT has been invited to participate in conference, organised by the Ministry of Finance of the Republic of Lithuania for 150 Honorary Consuls to Lithuania from all over the world. Titas Budrys, Board Member of Fintech Hub LT and CEO of one of the members, Seven Seas Europe talked on the topic "Why Lithuania is a great place for FinTechs? Short introduction from FinTechs themselves". Titas talked about what attracts and keeps FinTech companies in Lithuania and why FinTech sector right now might be an attractive investment and selling point of the country.

| |||

|

Fintech HUB LT signed the Memorandum of Understanding with QATAR Fintech HUBQATAR FINTECH HUB is global FinTech Hub with purpose to support the development of the FinTech industry in the State of Qatar. We work to facilitate collaboration among the participants and stakeholders of the FinTech ecosystem and to develop meaningful local and global relationships that will advance our FinTech vision. The Qatar FinTech Hub represents a range of stakeholders in the industry from early stage FinTech companies to large financial services companies and relevant service providers. The purpose of the MoU signed between FINTECH HUB LT and QATAR FINTECH HUB is to outline the intention to cooperate on the matters of mutual interests related to the FinTech industry, i.e. contribute to the development of the industry in general, collaborate on particular initiatives, exchange opinions, participate in the relevant events, support each other with regulators and other bodies within the industry. Full text of the MoU could be found below.

| ||

We are looking for Interns at Fintech HUB LT - Summer, 2018

|

FINTECH HUB LT is currently looking for Interns for the Summer of 2018.

WE OFFER an interesting opportunity to work within a group of FINTECH companies in Lithuania, learn about differnent business models and build a network. WE EXPECT interns to help us with organizing the work of the Association, work closely with our members, partners and other association, spreading the news about us, organizing our events, participating in other events and conferences on behalf of the Association. WE ARE OPEN to different internship terms and agreements including 3 party internship agreements with universities, full-time and part-time internships, etc. GET IN TOUCH with us now at [email protected] |

Fintech HUB LT has participated in the conference hosted by University of Applied SciencesFintech HUB LT was invited to speak during the international students conference titled “Economics. Business. Management - 2018” organized by the faculty of Economics. Together with students from Lithuania, Belarus, Russia, Ukraine, Poland, Latvia and Turkey we have discussed developing FinTech environment in Lithuania and exiting career opportunities in this area.

|

Fintech HUB LT has agreed with Lithuanian Universities to work towards making Fintech as one of the main R&D Strategies for Lithuania

|

Fintech HUB LT and its members have met with representatives of a few Lithuanian universities, namely Kaunas University of Technology, Mykolas Romeris University and Vilnius Gediminas Technical University, and agreed to work together towards adding FINTECH as one of the fields under European Commission's Research and Innovation Strategies for Smart Specialization for Lithuania.

With the approach of the new Multiannual Financial Framework (2014-2020) all EU members were obligated to formulate Research and Innovation Strategies for Smart Specialization (RIS3) which will guide further R&D and innovation system development in every member state. The priorities of R&D and innovation development should be determined considering the business potential for excellence, the strengths in research, technological development and innovation, also a capacity to foster the collaboration among different stakeholders to respond to national, regional and global challenges. More about Smart Specialization could be found here: http://sumani2020.lt/en/ |

Fintech HUB LT invited its members, colleagues and partners to its first Introduction EventA RECENTLY established association of FinTech (financial technology) industry participants in Lithuania FINTECH HUB LT has invited its members, colleagues and partners to its first Introduction Event. 10 representatives from FinTech companies based in Lithuania presented their activity and plans.

The participants had an opportunity to listen to presentations of the representatives of deVere E-Money, InstaRem, Pyrros Lithuania, ConnectPay, GloCash, Seven Seas Europe, Majestic Financial, Transactive Systems, ECOVIS Proventus Law, Paysera LT. The Speakers shared their experience in Lithuania: all speakers described favourable technological and legal environment in Lithuania for FinTech companies, as well as FinTech-friendly and fast regulator and excellent international-grade talent pool as the reasons why they chose Lithuania. |

Fintech HUB LT signed the Memorandum of Understanding with Singapore Fintech AssociationSINGAPORE FINTECH ASSOCIATION is a cross-industry and non-profit organization, with a purpose to support the development of FinTech industry and facilitate collaboration among the participants and stakeholders in FinTech ecosystem in Singapore. The purpose of the MoU signed between FINTECH HUB LT and Singapore FinTech Association is to outline the intention to cooperate on the matters of mutual interests related to the FinTech industry, i.e. contribute to the development of the industry in general, collaborate on particular initiatives, exchange opinions, participate in the relevant events, support each other with regulators and other bodies within the industry. Full text of the MoU could be found below.

| |||

Interested in Internship at Fintech HUB LT? - Spring, 2018

|

IF YOU are interested in FinTech sector and would like to get to know different companies during your intership, please send your CV and cover letter to [email protected].

|

WHILE THE aim of Lithuania to become a center of attraction for FinTech industry worldwide is turning into a reality, financial technology companies based in Lithuania have joined to create the association Fintech HUB LT. It intends to contribute to the creation of favourable conditions for the activities of industry's participants in Lithuania, promote Lithuania as the center of the financial technology industry in the Baltic region and the European Union, as well as explain the benefits of FinTech companies to consumers. The new association also aims to help Lithuania regain its talent, and there is little doubt that FinTech companies that are setting up here can make a major contribution to it.

|